Transaction Advisory (Mergers & Acquisitions)

Inorganic growth requires precision. We offers specialized expertise to navigate the complexities of M&A, ensuring value creation and risk mitigation.

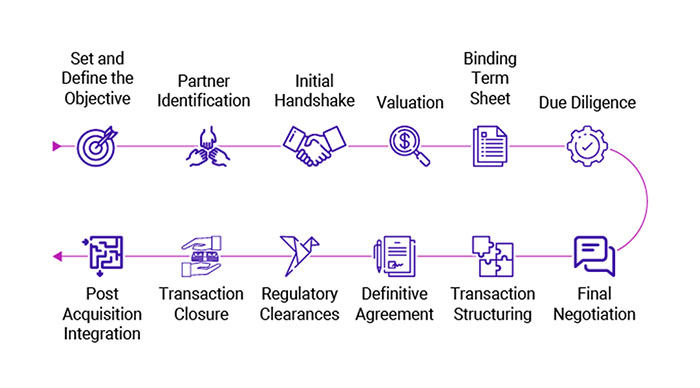

- Buy-Side & Sell-Side Advisory: Guiding organizations through the entire transaction lifecycle, from target identification and screening to deal structuring and closure.

- Financial & Tax Due Diligence: Conducting rigorous forensic analysis of target entities to validate financial health, uncover contingent liabilities, and assess tax risks.

- Valuation Services: delivering regulatory and commercial valuation reports to support fair pricing and negotiation leverage.

- Post-Merger Integration (PMI): Harmonizing financial reporting systems and accounting policies post-transaction to realize projected synergies.

Corporate Restructuring & Turnaround Services

Markets are dynamic, and agility is essential. We assist organizations in realigning their financial and operational structures to preserve value and restore profitability.

Financial Restructuring (Balance Sheet Optimization)

- Debt Syndication & Refinancing: Re-engineering debt profiles by negotiating favourable terms, consolidating obligations, or extending tenure to align with current cash flow capabilities.

- Liquidity Management: Analysing the debt-to-equity mix and unlocking trapped liquidity through non-core asset divestment or working capital restructuring.

- Settlement Advisory: Representing the client in One-Time Settlement (OTS) negotiations with financial institutions to resolve legacy liabilities.

Operational Restructuring (Profitability Enhancement)

- Cost Optimization: Utilizing Zero-Based Budgeting and variance analysis to eliminate inefficiencies without compromising core operational capabilities.

- Business Process Re-engineering: Mapping and redesigning workflows to eliminate redundancy, enhance automation, and improve throughput.

- Unit Economics Analysis: Granular analysis of product or divisional profitability to inform decisions regarding discontinuation or divestment of underperforming verticals.

Strategic Realignment

- Divestitures & Spin-offs: Structuring the separation of business units to unlock shareholder value or streamline corporate focus.

- Turnaround Management: For distressed entities, we provide immediate stabilization strategies, cash conservation protocols and stakeholder management to steer the organization back to solvency.

Beyond the Balance Sheet: Strategic Leadership for the Modern Enterprise.